Post History

I know that in Spanish, contengo is the first person singular conjugation of contener "to contain". I surmise that English transcribed the Spanish /e/ into an "a". Etymonline 1853, "charge made...

#4: Post edited

How does 'contango' semantically appertain to 'continue', or Spanish 'contengo'?

- How does 'contango' semantically appertain to (1) 'continue'? (2) Or 'contain' as in Spanish 'contengo'?

I know that _contengo_ is the first person singular conjugation of contener "to contain". I surmise that English transcribed the Spanish /e/ into an "a".- [Etymonline](https://www.etymonline.com/search?q=contango)

- > 1853, "charge made or percentage received by a broker or seller for deferring settlement of a stock sale," a stockbroker's invention,

- [1.] perhaps somehow derived from [continue](https://www.etymonline.com/word/continue?ref=etymonline_crossreference),

- [2.] or from Spanish _contengo_ "I contain, refrain, restrain, check."

- As a verb, from 1900.

What semantic notions underlie the 2 etymologies above, with _contango_'s financial meanings in 2022 below? Please expound BOTH etymologies! [This English Stack Exchange post](https://english.stackexchange.com/q/301151) doesn't expound the semantic shift.- >A futures market is said to be in _backwardation_ futures prices are below spot. It is said

- to be in _contango_ if futures prices are above spot. As we will see in Chapters 3 and 4, in

- a typical commodity market with a positive cost-of-carry, the theoretical futures price is

- above spot, i.e., the market should be in contango. However, in some commodity markets

- (notably oil) futures prices are often below spot. This phenomenon is commonly attributed

- to the presence of a large “convenience yield” from holding the spot commodity, an issue

- we discuss further in Chapter 4.

- Sanjiv Das, _Derivatives principles and practice_ (2016 2nd Edn), p 46.

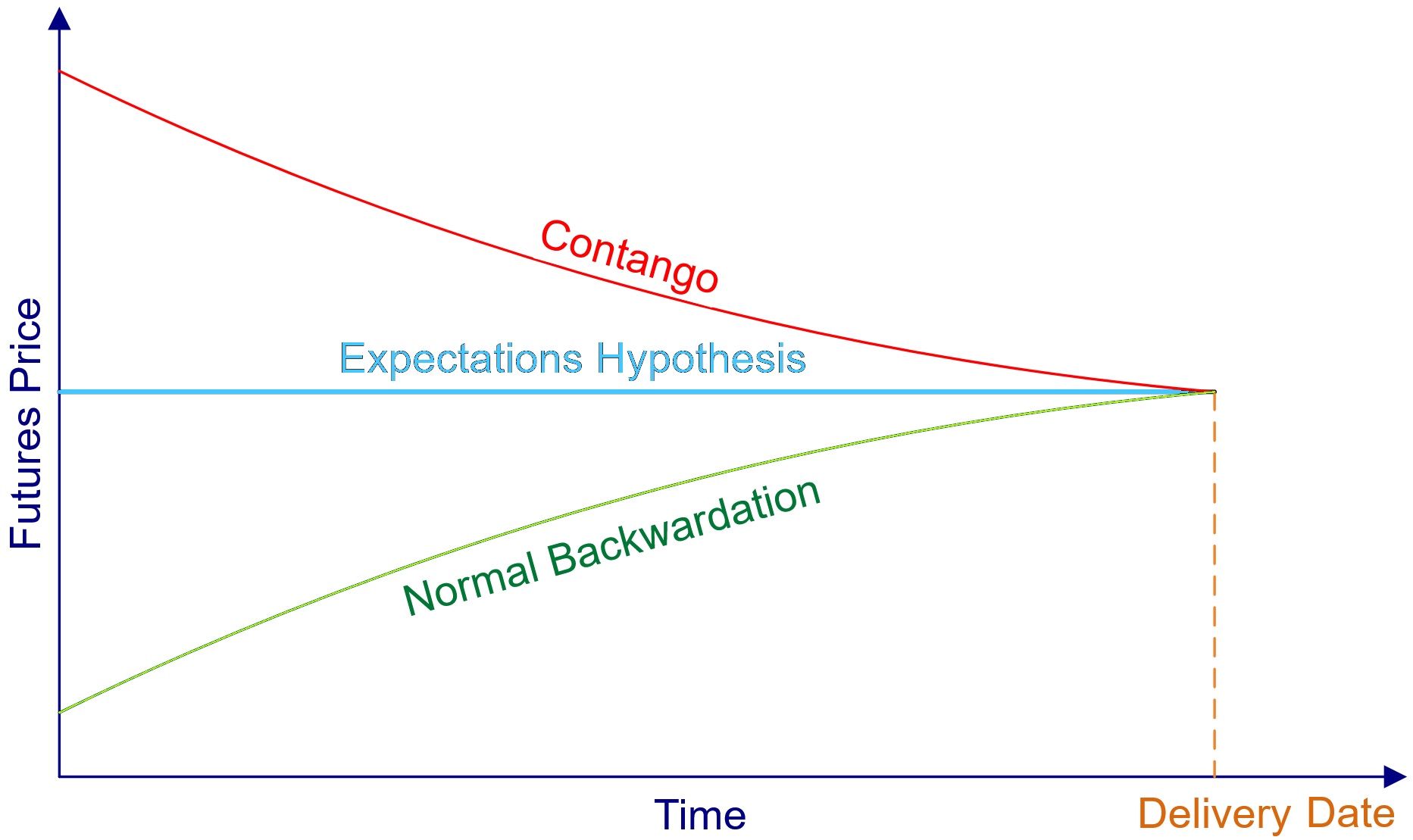

- >### Normal Backwardation and Contango

- >

- >When the futures price is below the expected future spot price, the situation is known as

- _normal backwardation_; and when the futures price is above the expected future spot

- price, the situation is known as _contango_. However, it should be noted that sometimes

- these terms are used to refer to whether the futures price is below or above the current

- spot price, rather than the expected future spot price.

- Hull, _Options, Futures, and Other Derivatives_ (11 edn 2022), p 125.

- >**Contango** A situation where the futures price is above the expected future spot price

- (also often used to refer to the situation where the futures price is above the current

- spot price).

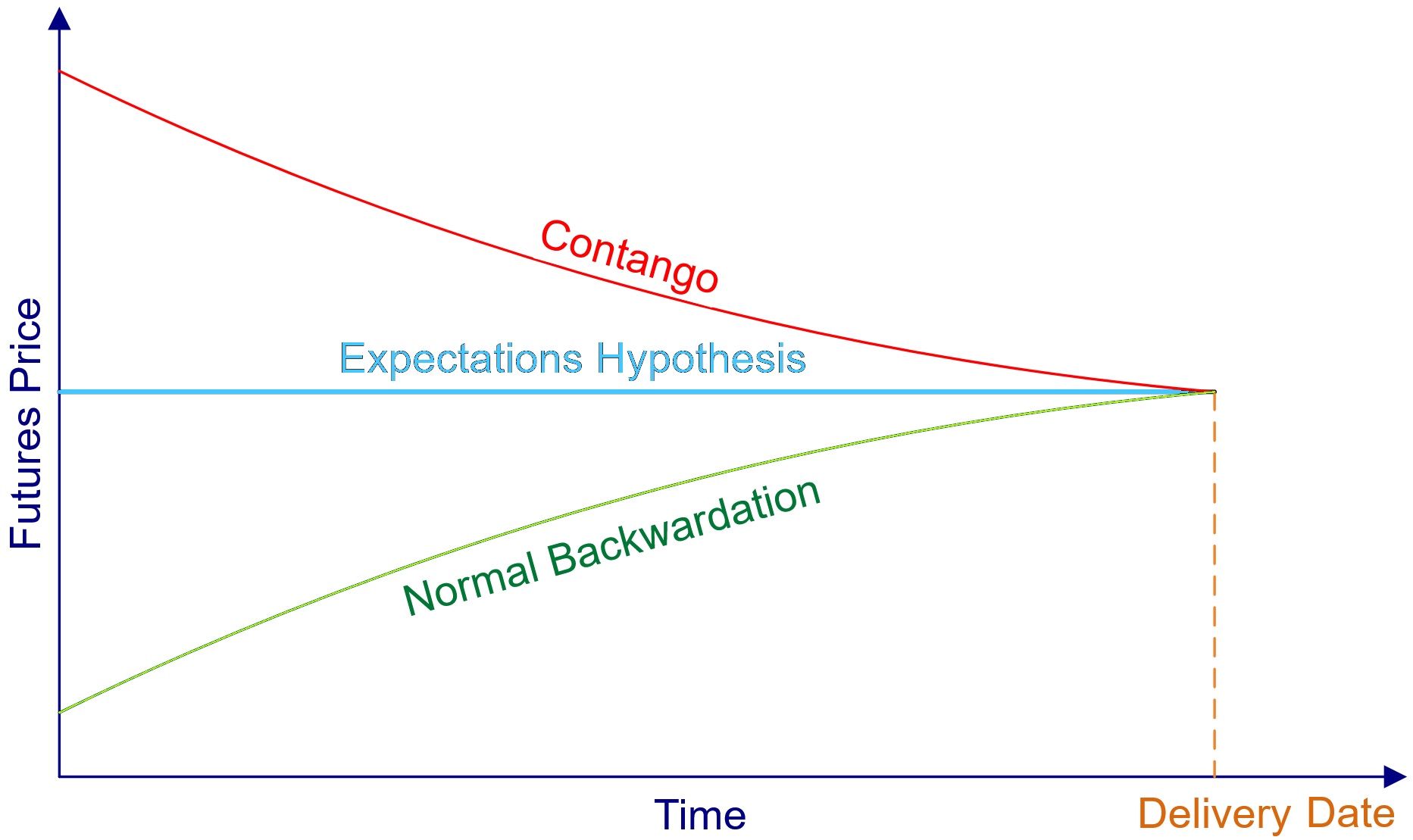

- Op. cit. p 809. [Source for graph below](https://thismatter.com/money/futures/futures-prices-expected-spot-prices.htm).

-

- I know that in Spanish, _contengo_ is the first person singular conjugation of _contener_ "to contain". I surmise that English transcribed the Spanish /e/ into an "a".

- [Etymonline](https://www.etymonline.com/search?q=contango)

- > 1853, "charge made or percentage received by a broker or seller for deferring settlement of a stock sale," a stockbroker's invention,

- [1.] perhaps somehow derived from [continue](https://www.etymonline.com/word/continue?ref=etymonline_crossreference),

- [2.] or from Spanish _contengo_ "I contain, refrain, restrain, check."

- As a verb, from 1900.

- **What semantic notions underlie the 2 etymologies above, with _contango_'s financial meanings in 2022 below?** **_What do _contango_'s financial meanings semantically relate — or have anything to do — with the notions of (1.) "continue" or (2.) Spanish contengo "I contain, refrain, restrain, check"?_** Please expound BOTH etymologies! [English Stack Exchange ](https://english.stackexchange.com/q/301151) doesn't expound the semantic shift.

- >A futures market is said to be in _backwardation_ futures prices are below spot. It is said

- to be in _contango_ if futures prices are above spot. As we will see in Chapters 3 and 4, in

- a typical commodity market with a positive cost-of-carry, the theoretical futures price is

- above spot, i.e., the market should be in contango. However, in some commodity markets

- (notably oil) futures prices are often below spot. This phenomenon is commonly attributed

- to the presence of a large “convenience yield” from holding the spot commodity, an issue

- we discuss further in Chapter 4.

- Sanjiv Das, _Derivatives principles and practice_ (2016 2nd Edn), p 46.

- >### Normal Backwardation and Contango

- >

- >When the futures price is below the expected future spot price, the situation is known as

- _normal backwardation_; and when the futures price is above the expected future spot

- price, the situation is known as _contango_. However, it should be noted that sometimes

- these terms are used to refer to whether the futures price is below or above the current

- spot price, rather than the expected future spot price.

- Hull, _Options, Futures, and Other Derivatives_ (11 edn 2022), p 125.

- >**Contango** A situation where the futures price is above the expected future spot price

- (also often used to refer to the situation where the futures price is above the current

- spot price).

- Op. cit. p 809. [Source for graph below](https://thismatter.com/money/futures/futures-prices-expected-spot-prices.htm).

-

#3: Post edited

- [Etymonline](https://www.etymonline.com/search?q=contango)

- > 1853, "charge made or percentage received by a broker or seller for deferring settlement of a stock sale," a stockbroker's invention,

- [1.] perhaps somehow derived from [continue](https://www.etymonline.com/word/continue?ref=etymonline_crossreference),

- [2.] or from Spanish _contengo_ "I contain, refrain, restrain, check."

- As a verb, from 1900.

- What semantic notions underlie the 2 etymologies above, with _contango_'s financial meanings in 2022 below? Please expound BOTH etymologies! [This English Stack Exchange post](https://english.stackexchange.com/q/301151) doesn't expound the semantic shift.

- >A futures market is said to be in _backwardation_ futures prices are below spot. It is said

- to be in _contango_ if futures prices are above spot. As we will see in Chapters 3 and 4, in

- a typical commodity market with a positive cost-of-carry, the theoretical futures price is

- above spot, i.e., the market should be in contango. However, in some commodity markets

- (notably oil) futures prices are often below spot. This phenomenon is commonly attributed

- to the presence of a large “convenience yield” from holding the spot commodity, an issue

- we discuss further in Chapter 4.

- Sanjiv Das, _Derivatives principles and practice_ (2016 2nd Edn), p 46.

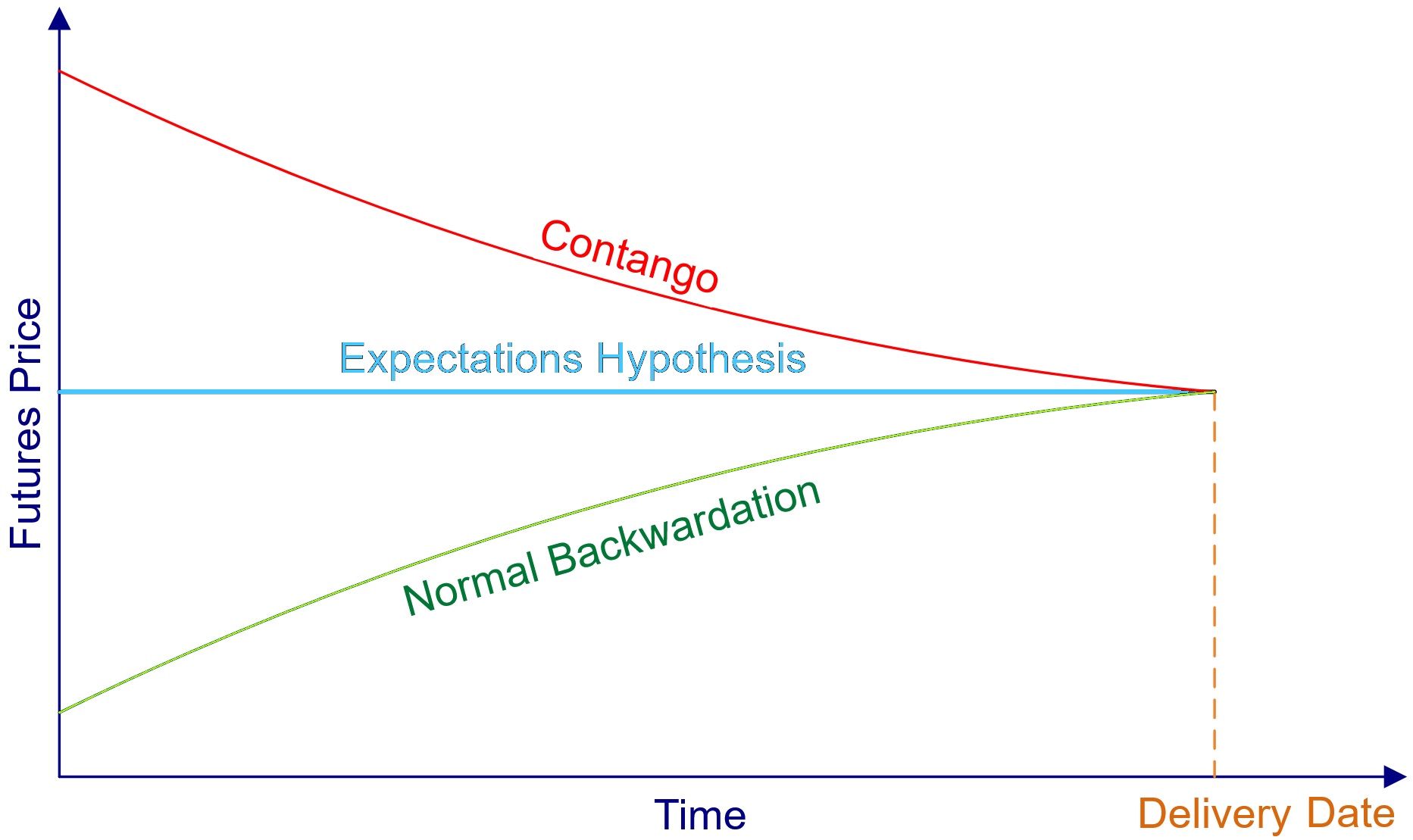

- >### Normal Backwardation and Contango

- >

- >When the futures price is below the expected future spot price, the situation is known as

- _normal backwardation_; and when the futures price is above the expected future spot

- price, the situation is known as _contango_. However, it should be noted that sometimes

- these terms are used to refer to whether the futures price is below or above the current

- spot price, rather than the expected future spot price.

- Hull, _Options, Futures, and Other Derivatives_ (11 edn 2022), p 125.

- >**Contango** A situation where the futures price is above the expected future spot price

- (also often used to refer to the situation where the futures price is above the current

- spot price).

- Op. cit. p 809. [Source for graph below](https://thismatter.com/money/futures/futures-prices-expected-spot-prices.htm).

-

- I know that _contengo_ is the first person singular conjugation of contener "to contain". I surmise that English transcribed the Spanish /e/ into an "a".

- [Etymonline](https://www.etymonline.com/search?q=contango)

- > 1853, "charge made or percentage received by a broker or seller for deferring settlement of a stock sale," a stockbroker's invention,

- [1.] perhaps somehow derived from [continue](https://www.etymonline.com/word/continue?ref=etymonline_crossreference),

- [2.] or from Spanish _contengo_ "I contain, refrain, restrain, check."

- As a verb, from 1900.

- What semantic notions underlie the 2 etymologies above, with _contango_'s financial meanings in 2022 below? Please expound BOTH etymologies! [This English Stack Exchange post](https://english.stackexchange.com/q/301151) doesn't expound the semantic shift.

- >A futures market is said to be in _backwardation_ futures prices are below spot. It is said

- to be in _contango_ if futures prices are above spot. As we will see in Chapters 3 and 4, in

- a typical commodity market with a positive cost-of-carry, the theoretical futures price is

- above spot, i.e., the market should be in contango. However, in some commodity markets

- (notably oil) futures prices are often below spot. This phenomenon is commonly attributed

- to the presence of a large “convenience yield” from holding the spot commodity, an issue

- we discuss further in Chapter 4.

- Sanjiv Das, _Derivatives principles and practice_ (2016 2nd Edn), p 46.

- >### Normal Backwardation and Contango

- >

- >When the futures price is below the expected future spot price, the situation is known as

- _normal backwardation_; and when the futures price is above the expected future spot

- price, the situation is known as _contango_. However, it should be noted that sometimes

- these terms are used to refer to whether the futures price is below or above the current

- spot price, rather than the expected future spot price.

- Hull, _Options, Futures, and Other Derivatives_ (11 edn 2022), p 125.

- >**Contango** A situation where the futures price is above the expected future spot price

- (also often used to refer to the situation where the futures price is above the current

- spot price).

- Op. cit. p 809. [Source for graph below](https://thismatter.com/money/futures/futures-prices-expected-spot-prices.htm).

-

#2: Post edited

- [Etymonline](https://www.etymonline.com/search?q=contango)

- > 1853, "charge made or percentage received by a broker or seller for deferring settlement of a stock sale," a stockbroker's invention,

- [1.] perhaps somehow derived from [continue](https://www.etymonline.com/word/continue?ref=etymonline_crossreference),

- [2.] or from Spanish _contengo_ "I contain, refrain, restrain, check."

- As a verb, from 1900.

- What semantic notions underlie the 2 etymologies above, with _contango_'s financial meanings in 2022 below? Please expound BOTH etymologies! [This English Stack Exchange post](https://english.stackexchange.com/q/301151) doesn't expound the semantic shift.

- >A futures market is said to be in _backwardation_ futures prices are below spot. It is said

- to be in _contango_ if futures prices are above spot. As we will see in Chapters 3 and 4, in

- a typical commodity market with a positive cost-of-carry, the theoretical futures price is

- above spot, i.e., the market should be in contango. However, in some commodity markets

- (notably oil) futures prices are often below spot. This phenomenon is commonly attributed

- to the presence of a large “convenience yield” from holding the spot commodity, an issue

- we discuss further in Chapter 4.

- Sanjiv Das, _Derivatives principles and practice_ (2016 2nd Edn), p 46.

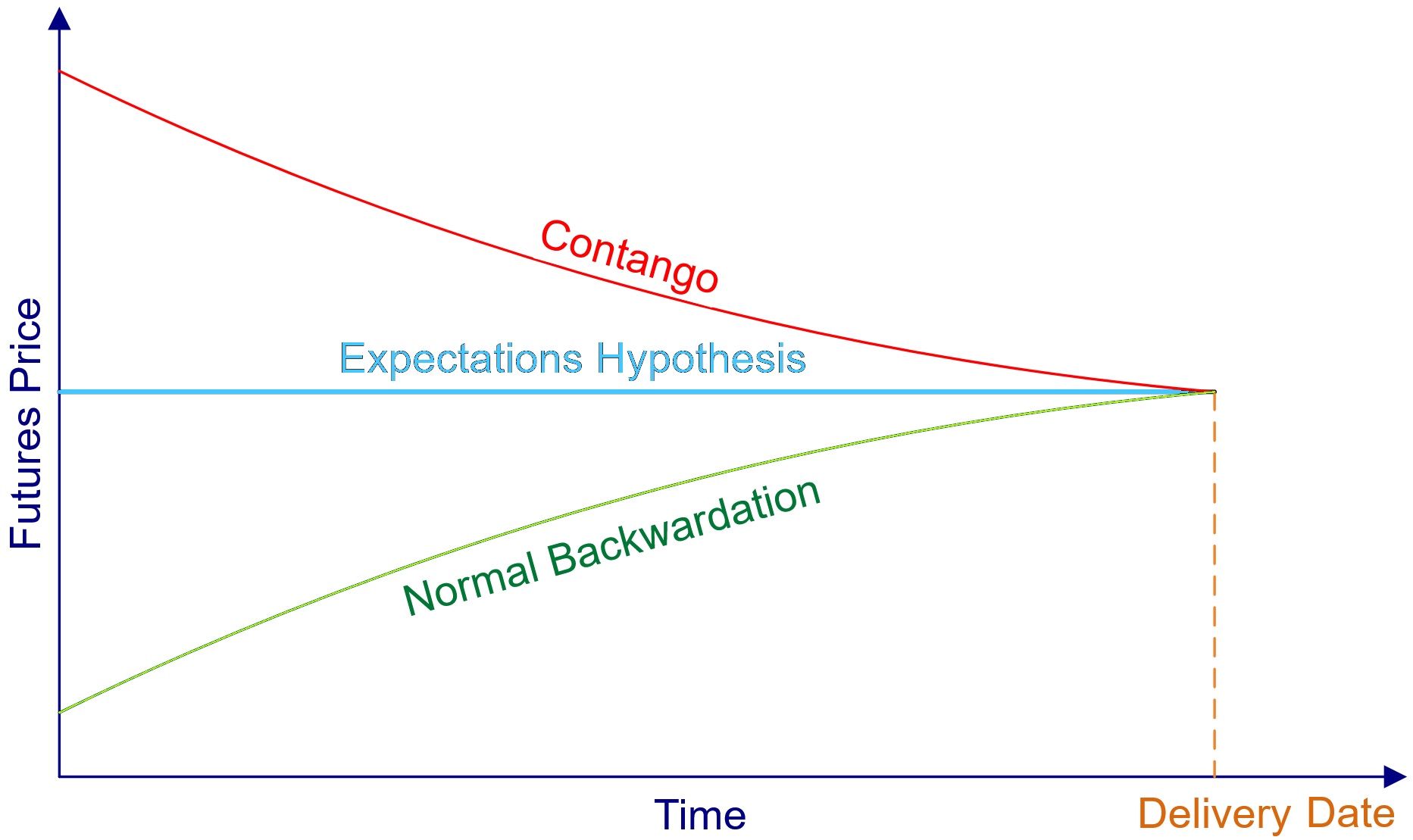

- >### Normal Backwardation and Contango

- >

- >When the futures price is below the expected future spot price, the situation is known as

- _normal backwardation_; and when the futures price is above the expected future spot

- price, the situation is known as _contango_. However, it should be noted that sometimes

- these terms are used to refer to whether the futures price is below or above the current

- spot price, rather than the expected future spot price.

- Hull, _Options, Futures, and Other Derivatives_ (11 edn 2022), p 125.

- >**Contango** A situation where the futures price is above the expected future spot price

- (also often used to refer to the situation where the futures price is above the current

- spot price).

- Op. cit. p 809. [Source for graph below](https://thismatter.com/money/futures/futures-prices-expected-spot-prices.htm).

- [Etymonline](https://www.etymonline.com/search?q=contango)

- > 1853, "charge made or percentage received by a broker or seller for deferring settlement of a stock sale," a stockbroker's invention,

- [1.] perhaps somehow derived from [continue](https://www.etymonline.com/word/continue?ref=etymonline_crossreference),

- [2.] or from Spanish _contengo_ "I contain, refrain, restrain, check."

- As a verb, from 1900.

- What semantic notions underlie the 2 etymologies above, with _contango_'s financial meanings in 2022 below? Please expound BOTH etymologies! [This English Stack Exchange post](https://english.stackexchange.com/q/301151) doesn't expound the semantic shift.

- >A futures market is said to be in _backwardation_ futures prices are below spot. It is said

- to be in _contango_ if futures prices are above spot. As we will see in Chapters 3 and 4, in

- a typical commodity market with a positive cost-of-carry, the theoretical futures price is

- above spot, i.e., the market should be in contango. However, in some commodity markets

- (notably oil) futures prices are often below spot. This phenomenon is commonly attributed

- to the presence of a large “convenience yield” from holding the spot commodity, an issue

- we discuss further in Chapter 4.

- Sanjiv Das, _Derivatives principles and practice_ (2016 2nd Edn), p 46.

- >### Normal Backwardation and Contango

- >

- >When the futures price is below the expected future spot price, the situation is known as

- _normal backwardation_; and when the futures price is above the expected future spot

- price, the situation is known as _contango_. However, it should be noted that sometimes

- these terms are used to refer to whether the futures price is below or above the current

- spot price, rather than the expected future spot price.

- Hull, _Options, Futures, and Other Derivatives_ (11 edn 2022), p 125.

- >**Contango** A situation where the futures price is above the expected future spot price

- (also often used to refer to the situation where the futures price is above the current

- spot price).

- Op. cit. p 809. [Source for graph below](https://thismatter.com/money/futures/futures-prices-expected-spot-prices.htm).

-

#1: Initial revision

How does 'contango' semantically appertain to 'continue', or Spanish 'contengo'?

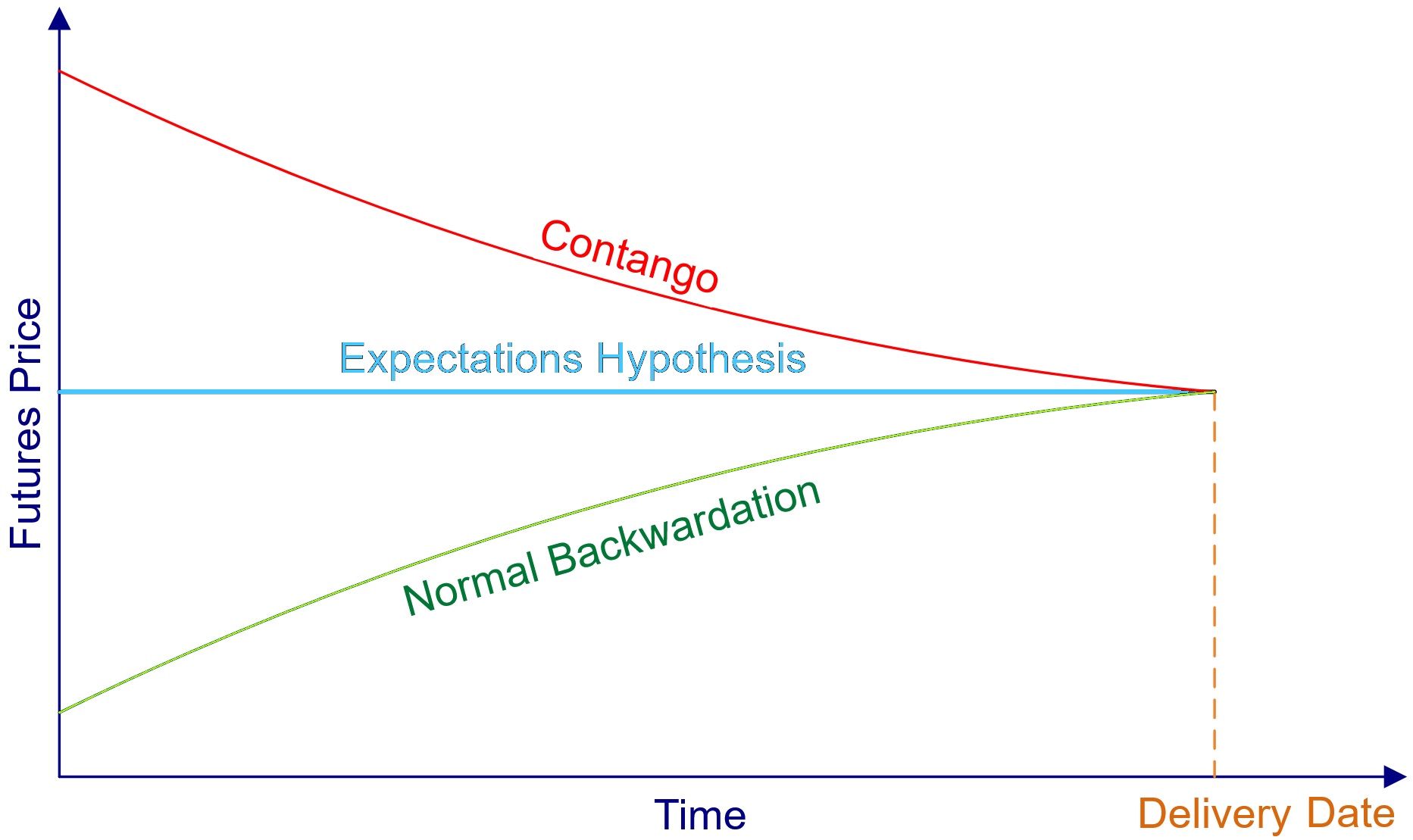

[Etymonline](https://www.etymonline.com/search?q=contango) > 1853, "charge made or percentage received by a broker or seller for deferring settlement of a stock sale," a stockbroker's invention, [1.] perhaps somehow derived from [continue](https://www.etymonline.com/word/continue?ref=etymonline_crossreference), [2.] or from Spanish _contengo_ "I contain, refrain, restrain, check." As a verb, from 1900. What semantic notions underlie the 2 etymologies above, with _contango_'s financial meanings in 2022 below? Please expound BOTH etymologies! [This English Stack Exchange post](https://english.stackexchange.com/q/301151) doesn't expound the semantic shift. >A futures market is said to be in _backwardation_ futures prices are below spot. It is said to be in _contango_ if futures prices are above spot. As we will see in Chapters 3 and 4, in a typical commodity market with a positive cost-of-carry, the theoretical futures price is above spot, i.e., the market should be in contango. However, in some commodity markets (notably oil) futures prices are often below spot. This phenomenon is commonly attributed to the presence of a large “convenience yield” from holding the spot commodity, an issue we discuss further in Chapter 4. Sanjiv Das, _Derivatives principles and practice_ (2016 2nd Edn), p 46. >### Normal Backwardation and Contango > >When the futures price is below the expected future spot price, the situation is known as _normal backwardation_; and when the futures price is above the expected future spot price, the situation is known as _contango_. However, it should be noted that sometimes these terms are used to refer to whether the futures price is below or above the current spot price, rather than the expected future spot price. Hull, _Options, Futures, and Other Derivatives_ (11 edn 2022), p 125. >**Contango** A situation where the futures price is above the expected future spot price (also often used to refer to the situation where the futures price is above the current spot price). Op. cit. p 809. [Source for graph below](https://thismatter.com/money/futures/futures-prices-expected-spot-prices.htm).